1 | Prescribed application Form:A , Statement of raw material purchased as per Annexure-1, Statement showing utilization of raw material and finished products manufactured during the claim period as per Annexure-II, Statement of finished goods transported to places outside NER/within NER during the claim period as per Annexure-III, Statement of used of Vehicle as per Form:B and Undertaking as per Form:C |

2 | Valid FSS Registration Certificate issued by DICC and copy of EM-II/IEM as applicable. |

3 | Company registration Certificate with article of memorandum of Association , list of Partners/Directors with PAN no . |

4 | Land documents, Lease/rent agreement , as the case may be. |

5 | VAT/CST/Income Tax/Central Excise/Service tax registration and Certificate of payment of various taxes. |

6 | NOC from local body , Consent of operation from Pollution Control Board of Assam and Factory License no & date. |

7 | Power sanction letter and 1st bill, Ist bill of Purchase of Raw materials and selling of finished products , Road/Railway/IWT distance certificate from competent authority. |

8 | Freight quotation from NF Railway/ Airport authority/ Inland Water transport , as applicable. |

9 | Bank sanction letter, Account number, factory license no & date. |

10 | CA Certificate in respect of Raw materials and finished products. |

11 | All Bills/ Challan / Copies of Registration Certificate (RC) of vehicles/Railway Receipt (RR) |

12 | Employment Certificate from Competent Authority along with list of employees. |

13 | Bank statement for payment made to transporters during the period. |

14 | Capacity assessment certificate indicating quantum of finished goods produced per unit consumption of power and diesel (Joint assessment report by the concerned officer of MSME, Commissioner of Industries and District Industries & Commerce Centre. |

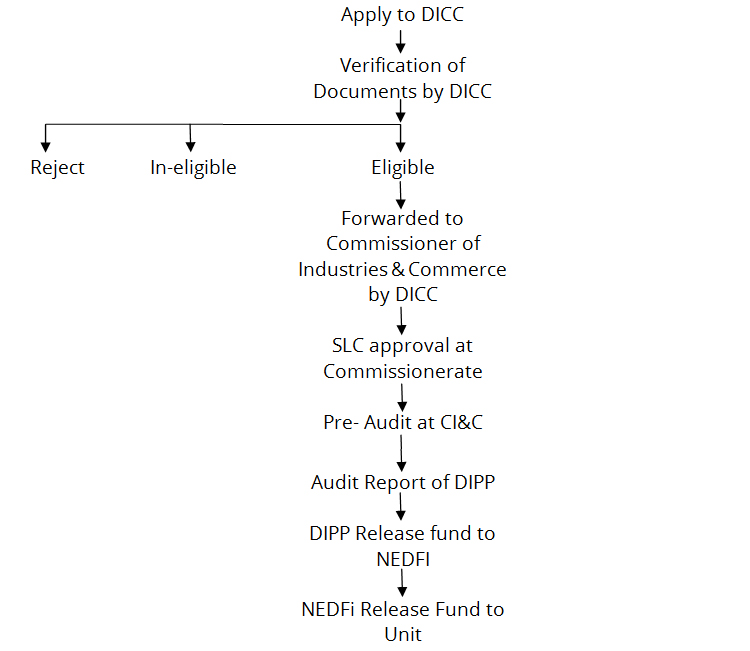

Flow Chart for applying for claim under Freight Subsidy Scheme, 2013

1 | Apply in the prescribed application Form along with all relevant Forms/Annexure, Documents, certificates, etc to the General Manager, DICC of the concerned district on quarterly basis. |

2 | On receipt of the application and relevant supporting documents as per checklist, same should be verified by the district officials of DICC and forwarded to the Commissionerate of Industries & Commerce within 30 days from the date of receipt of application. |

3 | On receipt of the application along with the supporting documents from the DICC, it would be re-verified through a team of officials of Commissionerate and placed before the State Level Committee (SLC) constituted for the purpose for approval. |

4 | On approval of SLC, the minutes of the meeting will be forwarded to DIPP to depute a Pre- Audit team to re-examine the proposals. |

5 | On receipt of Report of Pre-Audit team, DIPP will release fund to NEDFi for further disbursement to the unit. |

Forms to be filled (link to the appropriate forms within the forms folder)

Form-A | : | Form of Claiming Freight Subsidy Scheme, 2013 |

Form-B | : | Statement of Vehicles used for Transportation of Raw materials during the Claim period |

Form-C | : | Self-Certificate/Undertaking |

Annexure-I | : | Statement of Raw materials purchased from outside the North Eastern Region during the period from .............. to ............... |

Annexure-II | : | Statement Showing the Utilization of Raw materials and Finished products manufactured during the period from ...... to ...... |

Annexure-III | : | Statement of finished products transported to places outside the North Eastern Region during the period from ..... to ...... |

Guidelines for filling up the form:

Eligibility Criteria

Fees including payment mode:

There are no fees for claiming under Freight Subsidy Scheme, 2013.

(a) Certificates, NOC, etc.

As per checklist, following certificates, as applicable, are required to be submitted:

| For Ist Claim |

1 | Prescribed application Form:A , Statement of raw material purchased as per Annexure-1, Statement showing utilization of raw material and finished products manufactured during the claim period as per Annexure-II, Statement of finished goods transported to places outside NER/within NER during the claim period as per Annexure-III, Statement of used of Vehicle as per Form:B and Undertaking as per Form:C |

2 | Valid FSS Registration Certificate issued by DICC and copy of EM-II/IEM as applicable. |

3 | Company registration Certificate with article of memorandum of Association , list of Partners/Directors with PAN no . |

4 | Land documents, Lease/rent agreement , as the case may be. |

5 | VAT/CST/Income Tax/Central Excise/Service tax registration and Certificate of payment of various taxes. |

6 | NOC from local body , Consent of operation from Pollution Control Board of Assam and Factory License no & date. |

7 | Power sanction letter and 1st bill, Ist bill of Purchase of Raw materials and selling of finished products , Road/Railway/IWT distance certificate from competent authority. |

8 | Freight quotation from NF Railway/ Airport authority/ Inland Water transport , as applicable. |

9 | Bank sanction letter, Account number, factory license no & date. |

10 | Submission of information , declaration , etc as per prescribed Forms and Annexures. |

11 | CA Certificate in respect of Raw materials and finished products. |

12 | All Bills/ Challan / Copies of Registration Certificate (RC) of vehicles/Railway Receipt (RR) |

13 | Employment Certificate from Competent Authority along with list of employees. |

14 | Bank statement for payment made to transporters during the period. |

15 | Capacity assessment certificate indicating quantum of finished goods produced per unit consumption of power and diesel (Joint assessment report by the concerned officer of MSME, Commissioner of Industries and District Industries & Commerce Centre. |

Checklist for subsequent claim:

1 | Prescribed application Form:A , Statement of raw material purchased as per Annexure-1, Statement showing utilization of raw material and finished products manufactured during the claim period as per Annexure-II, Statement of finished goods transported to places outside NER/within NER during the claim period as per Annexure-III, Statement of used of Vehicle as per Form:B and Undertaking as per Form:C. |

2 | VAT clearance certificate for the relevant period and VAT payment challan/VAT return |

3 | Affidavit as per prescribed format that the unit has not claimed subsidy from any other source. |

4 | Balance sheet for the relevant period showing carriage inward and outward. |

5 | Power bills and proof of payment for the relevant period. |

6 | CA Certificate in respect of Raw material & Finished Goods for the relevant period. |

7 | Consent of Operation from Pollution Control Board for the relevant period. |

8 | Bills and challan for raw materials purchased from the supplier for the relevant period. |

9 | Receipt from transporters for carrying goods (raw material/finished products) for the relevant period. |

10 | Bills and challan consignment note for finished goods dispatched. |

11 | In case of excisable goods produced by the unit: |

12 | In case of local sale; detailed address of purchasers with payment receipt details (cash/cheque etc) CA certificate on the body of the statement. |

13 | In case of purchase of RM from outside NER and from within NER: Copy of challan and Consignment Note of transporter endorsed to purchaser. |

14 | Employment Certificate from Competent Authority along with list of employees. |

15 | Affidavit by the unit certifying registration no. of trucks carrying raw material and finished goods to and from the factory for the relevant period. |

16 | Attested copies of RC of vehicles transporting raw material and finished goods to and from the factory and road permit issued by Transport Department or authentic Govt. documents incorporating the truck no. |

17 | In case of expansion unit, new capacity assessment certificate to be attached. |

18 | Bank Statement for payment made to transporters during the period (payment by cheque only). |

19 | In case of finished products sold outside NER or within NER |

20 | In case of Flour Mill following documents are to be enclosed:- |

(b) Photo ID, size, Quality, Signature, etc

Every documents need to be signed by te authorized persons. No photo ID is required for filling application. Applicant may put digital signature , if so desired.

(a) Due date for submission:

The Claim application should be submitted to the concerned DICC on quarterly basis but within one year from the date of incurring expenditure on transportation of Raw materials and finished goods.

(b) Time for processing ( approximate)

The application will be processed at the DICC level and to be forwarded to the Commissionerate within 30 days from the date of receipt of the application. After thorough re-verification, the proposal will be placed before the SLC for approval within 180 days.

i. Steps for applying

1 | Apply in the prescribed application Form along with all other relevant Annexures, Documents, certificates, etc to the General Manager, DICC of the concerned district on quarterly basis. |

2 | On receipt of the application and supporting documents, the same should be verified by the district officials of DICC and forwarded to the Commissionerate of Industries & Commerce within 30 days from the date of receipt of the application. |

3 | On receipt of the application from the DICC, it would be re-verified through a team of officials of Commissionerate and placed before the State Level Committee for approval. |

ii. Complete form with supporting documents to be submitted concerned DICC.

iii. Details guidelines may be obtained at www.easeofdoingbusinessinassam.in or www.dipp.nic.in.

iv. Ensure that all the relevant documents ready with the applicant.

v. There is no fee to pay for this service.

Whom to contact for any queries:

For any queries, the applicant may contact General Manager, DICCs, OR may send mail . Addresses of the General Manager DICCs with their mail & Phone number is as follows:

Addresses of District Industries & Commerce Centres (DICC), Assam

Sl no | Name of DICC | Address of DICC with e-mail | Name of General Manager | Contact no of General Manager |

1 | Baska | The General Manager | D Das | 9864115695 |

2 | Barpeta | The General Manager | D K Baruah | 9435140042 |

3 | Bongaigaon | The General Manager | Lila Bora | 9435314814 |

4 | Cachar | The General Manager | Gautom Das | 9435192612 |

5 | Chirang | The General Manager | Kishore Das | 9435020604 |

6 | Darrang | The General Manager | P K Goswami | 9954252341 |

7 | Dhemaji | The General Manager | B K Hazarika | 9435032193 |

8 | Dhubri | The General Manager | P K Sharma | 9435049445 |

9 | Dibrugarh | The General Manager | R Lagashu | 9435035207, |

10 | Dima Hasao | The General Manager | S R Pegu | 9864078533, 03673-236826 |

11 | Goalpara | The General Manager | Biswajit Das | 9435100143, |

12 | Golaghat | The General Manager | R J Sabhapandit | 9435359731 |

13 | Hailakandi | The General Manager |

| 03844-223133 |

14 | Jorhat | The General Manager | H R Deori | 9864042694 |

15 | Kamrup (Metro) | The General Manager | P K Bora | 9435335847 |

16 | Karbi Anglong | Additional Director of Industries & Commerce | H K Sharma (II) | 9435064294 |

17 | Karimganj | The General Manager |

| 03843-273130/274210 |

18 | Kokrajhar | The General Manager | P Hazarika | 9864050149, |

19 | Lakhimpur | The General Manager | I B Konowar | 03752-222405 |

20 | Morigaon | The General Manager | H K Borkotoki | 9435061712, |

21 | Nagaon | The General Manager | A K Nath | 9435164668 |

22 | Nalbari | The General Manager | T Ahmed | 9435385253, |

23 | Sivasagar | The General Manager | Hitesh Deori | 9435350938, |

24 | Sonitpur | The General Manager | M C Deka | 9954030201, 03712-220290 |

25 | Tinsukia | The General Manager | A K Baruah | 9864255814, |

26 | Udalguri | The General Manager | J Rangpi | 9435067048, |

27 | Kamrup (Rural) | The General Manager | Hemangadip Das i/c | 9435014772 |

Whether the service is offline or online:

Application to be submitted to concerned District Industries & Commerce Centre.

Service outcome :

The unit may enjoy the benefit under the Freight Subsidy Scheme, 2013