Overview

The Industrial and Investment Policy of Assam , 2014 was declared by the State Government have laid down of fiscal incentives for investors in Assam . The policy would be valid for five years w.e.f 1/3/2014 and all new units as well as existing unit undergoing substantial expansion, modernization and diversification shall be eligible to enjoy the incentives under the policy.

The highlights of the incentives under the policy are:

(a) State Capital Investment subsidy for Micro units

(b) Tax Exemption which includes (i) Value Added Tax exemption, (ii) Entry Tax exemption , (iii) Luxury and Tax Exemption.

(c) Subsidy on quality Certification/Technical knowhow

(d) 20% State Capital Subsidy on cost of PV Modules upto 20 KW.

Salient features

Glossary terms

DLC District Level Committee

SLC State Level Committee

AIDC Assam Industrial Development Corporation Ltd

VAT Value Added Tax

EM Entrepreneurs' Memorandum

IEM Industrial Entrepreneurs' Memorandum

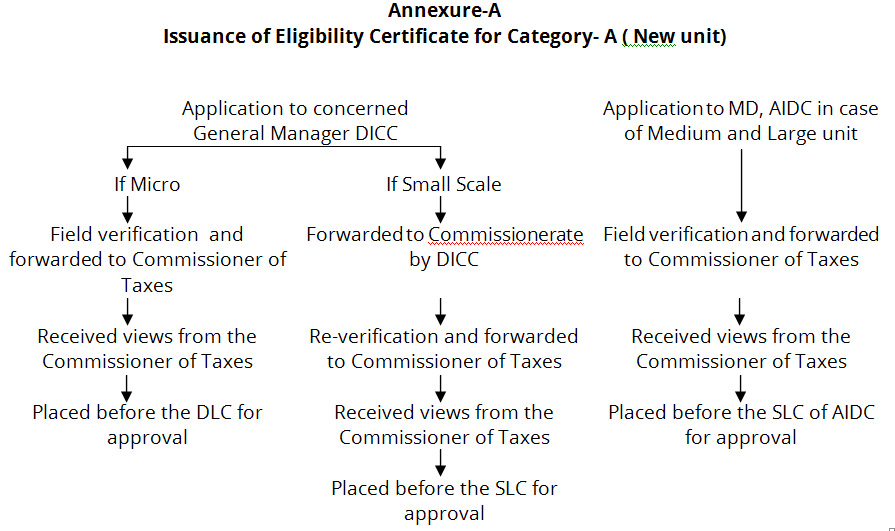

Description of the Sequence of steps depicted in above diagram:

1 | Application to be submitted offline along with all relevant documents as per checklist. |

A. Proposal for District Level Committee (DLC) for Micro unit | |

| (a) If the proposal for a Micro unit ( where the investment in plant & machinery upto Rs.25 lakh) , the application shall be submitted to concerned DICC. |

| (b) On receipt of the application, the DICC will verify all relevant documents ,its eligibility and after that the proposal shall be placed before the DLC within 60 days for grant of Eligibility Certificate. |

B. Proposal for State Level Committee (SLC) for Small unit | |

| (a) If the proposal for a Small scale unit ( where the investment in plant & machinery above Rs.25 lakh and upto Rs.500 lakh) , the application shall be submitted to concerned DICC. |

| (b) On receipt of the application, the DICC will verify all relevant documents, its eligibility and after that the proposal shall be forwarded to the Commissionerate within 30 days. |

| (c) On receipt of the application at Commissionerate , same shall be re-examined/re-verified and forwarded to the Commissioner of Taxes, Assam for views. |

| (d) On receipt of the views from the Commissioner of Taxes, Assam , the same shall be placed before the SLC for grant of Eligibility Certificate. |

C. Proposal for State Level Committee of AIDC for Medium & Large unit | |

| (a) If the proposal for a Large unit ( where the investment in plant & machinery above Rs.500 lakh ) , the application shall be submitted directly to the Managing Director, Assam Industrial Development Corporation Ltd ( AIDC Ltd). |

| (b) On receipt of the application, the AIDC will verify all relevant documents, its eligibility and after that the proposal shall be forwarded to the Commissioner of Taxes, Assam within 30 days. |

| (c) On receipt of the views from the Commissioner of Taxes, Assam , the same shall be placed before the SLC of AIDC for grant of Eligibility Certificate. |

(i) The activity should under the purview of the Industrial and Investment Policy of Assam , 2014 and should not be in negative list.

(ii) The unit should follow the employment criteria as per the policy.

(i) All columns of the form are to be filled up

(ii) Applicant may also put their digital signature in the specific column.

There are no fee for applying for Eligibility Certificate under the policy.

1. Constitution of the unit:

(a) In case of partnership unit, registered deed of partnership with general power of attorney.

(b) In case of private limited/public limited company:

(i) Registration certificate under the Companies Act

(ii) Memorandum and Articles of Associations

(iii) List of board of Directors

(c) In case of co-operative society:

(i) Resolution of the General Body for registration of the unit under SSI, if any

(ii) Registration certificate

(iii) Memorandum of Articles of Association

2. Registration certificate from the District Industries Centre (provisional and permanent) and LI/IL/IEM etc., if any.

3. Land and building :

(a) In case of Government land allotted by Government - Allotment letter, Trace map and receipt of the premium paid to the Government for the allotment.

(b) In case of lease hold land from a private owner - Lease Deed Agreement along with the general power of attorney and trace map.

(c) In case of own land :

(i) Purchase deed

(ii) Upto non-incumbency certificate

(iii) Jamabandi copy and trace map

(d) In case of Government land allotted by any Government agency

(i) Allotment letter and trace map

(ii) Deed of agreement.

(e) In case of industrial shed allotment by any Government agency :

(i) Allotment letter

(ii) Deed of agreement.

4. Sanction letter from the Financial Institution/Bank/ for Term Loan and Working Capital Loan.

5. Power:

(i) Power sanction letter.

(ii) Estimate of cost prepared by the ASEB.

(iii) Test report.

(iv) First bill of ASEB.

(v) NOC for installation of generating set from the concerned authority.

6. List of plant and machinery including all bills/vouchers/money receipt.

7. Certificate from a Chartered Accountant for fixed capital investment.

8.

(i) List of employees indicating, category, status, date of joining, monthly pay (based on daily attendance register of the unit on the date of application for the grant of eligibility certificate).

(ii) Employment certificate from the District Employment Officer.

9.

(i) Project report of the unit.

(ii) Money receipt from the consultant for preparation of the project report.

10. First bill(s) money receipt(s) on the purchase of raw materials(s).

11. Challan against the first sale of finished product(s).

12. Source of own finance/equity with supporting documents.

13. Agreement with National Research and Development Corporation for providing technical knowhow etc.

14. No objection certificate from the local bodies/authority and trade licenses, if any.

15. NOC from the pollution Control Board of Assam.

16. Copy of registration certificate under the Assam Value Added Tax Act, 2003.

17. Upto date sales tax clearance certificate from the Prescribed Authority.

18. Latest income tax clearance certificate in the name of the unit.

19. Eligibility certificate(s) issued, if any, to the unit before the present application with the name(s) of the scheme(s).

20. Any other documents sought for by the authority concerned.

Photo ID, size, quality , signature, etc

No photo ID is required for submission of application form for Eligibility Certificate.

(a) Due date of Submission:

The application for issuance of Eligibility Certificate should be submitted within one year from the date of commercial production.

(b) Time for processing :

180 days from the date of submission of application form.

1 | The unit should be eligible under the Industrial & Investment Policy of Assam , 2014 having EM-II or IEM as applicable. |

2 | Applicant along with all relevant documents to submit their application to DICC in case of Micro and Small enterprise. |

3 | In case of Micro unit, DICC will verified the documents and after that same shall be placed before the DLC for grant of Eligibility Certificate. In case of Small enterprise DICC will examine the documents and after field visit, the same shall be forwarded to the Commissionerate within 30 days. |

4 | On receipt of proposal of Small Enterprise, the same shall be verified at the Commissionerate level and forwarded to the Commissioner of Taxes, Assam for their views. |

5 | On receipt of views from the Commissioner of Taxes, Assam , the proposal/s will be placed before the SLC for grant of Eligibility Corticated. |

6 | In case of Medium and Large industries , the proposal shall be submitted directly to AIDC Ltd. |

7 | On receipt of the proposal, AIDC will examine the proposal and forwarded to the Commissioner of Taxes, Assam for their views. |

8 | On receipt of views from the Commissioner of Taxes, Assam , the proposal shall be placed before the SLC at AIDC for grant of Eligibility Certificate. |

(i) Application to be submitted to concerned General Manager, DICC in case of Micro and Small Enterprise.

(ii) Application to be submitted to Managing Director , Assam Industrial Development Corporation Ltd, RGB Road, Guwahati- 781 024 , in case of Large enterprise.

Service outcome : The unit may enjoy the benefit under the VAT exemption scheme, 2015.

FORM NO :A: APPLICATION FOR GRANTOF LEGIBILITY CERTIFICATE [ CATEGORY-"A" UNIT ( NEW UNIT)-PARA- 4 (2)]

FORM NO: A.1 : CERTIFICATE FROM THE REGISTERED CHARTERED ACCOUNTANT

For any queries, the applicant may contact General Manager, DICCs, OR may send mail Or may call to helpline No:9613191022. Addresses of the General Manager DICCs with their mail & Phone number is as follows:

S. N. | Name of DICC | Address of DICC with e-mail | Name of General Manager | Contact no of General Manager |

1 | Baska | The General Manager | D Das | 9864115695 |

2 | Barpeta | The General Manager | D K Baruah | 9435140042 |

3 | Bongaigaon | The General Manager | Lila Bora | 9435314814 |

4 | Cachar | The General Manager | Gautom Das | 9435192612 |

5 | Chirang | The General Manager | Kishore Das | 9435020604 |

6 | Darrang | The General Manager | P K Goswami | 9954252341 |

7 | Dhemaji | The General Manager | B K Hazarika | 9435032193 |

8 | Dhubri | The General Manager | P K Sharma | 9435049445 |

9 | Dibrugarh | The General Manager | R Lagashu | 9435035207, |

10 | Dima Hasao | The General Manager | S R Pegu | 9864078533, 03673-236826 |

11 | Goalpara | The General Manager | Biswajit Das | 9435100143, |

12 | Golaghat | The General Manager | L J Bora | 9435013210 |

13 | Hailakandi | The General Manager |

| 03844-223133 |

14 | Jorhat | The General Manager | H R Deori | 9864042694 |

15 | Kamrup (Metro) | The General Manager | P K Bora | 9435335847 |

16 | Karbi Anglong | Additional Director of Industries & Commerce | H K Sharma (II) | 9435064294 |

17 | Karimganj | The General Manager |

| 03843-273130/274210 |

18 | Kokrajhar | The General Manager | P Hazarika | 9864050149, |

19 | Lakhimpur | The General Manager | I B Konowar | 03752-222405 |

20 | Morigaon | The General Manager | H K Borkotoki | 9435061712, |

21 | Nagaon | The General Manager | A K Nath | 9435164668 |

22 | Nalbari | The General Manager | T Ahmed | 9435385253, |

23 | Sivasagar | The General Manager | Hitesh Deori | 9435350938, |

24 | Sonitpur | The General Manager | M C Deka | 9954030201, 03712-220290 |

25 | Tinsukia | The General Manager | A K Baruah | 9864255814, |

26 | Udalguri | The General Manager | J Rangpi | 9435067048, |

27 | Kamrup (Rural) | The General Manager | Hemangadip Das i/c | 9435014772 |